What Is Merchant-Funded EMI and How Does It Work?

In a highly competitive retail landscape, offering flexible payment options has become more of a necessity than a luxury. Consumers are increasingly seeking ways to make purchases without feeling the burden of immediate full payment. Among the most effective strategies that businesses are turning to is the concept of Merchant-Funded EMIs (Equated Monthly Installments). But what exactly is a merchant-funded EMI, and how does it work? Let’s explore this innovative model and understand how it's transforming the way businesses sell and customers buy.

What Is a Merchant-Funded EMI?

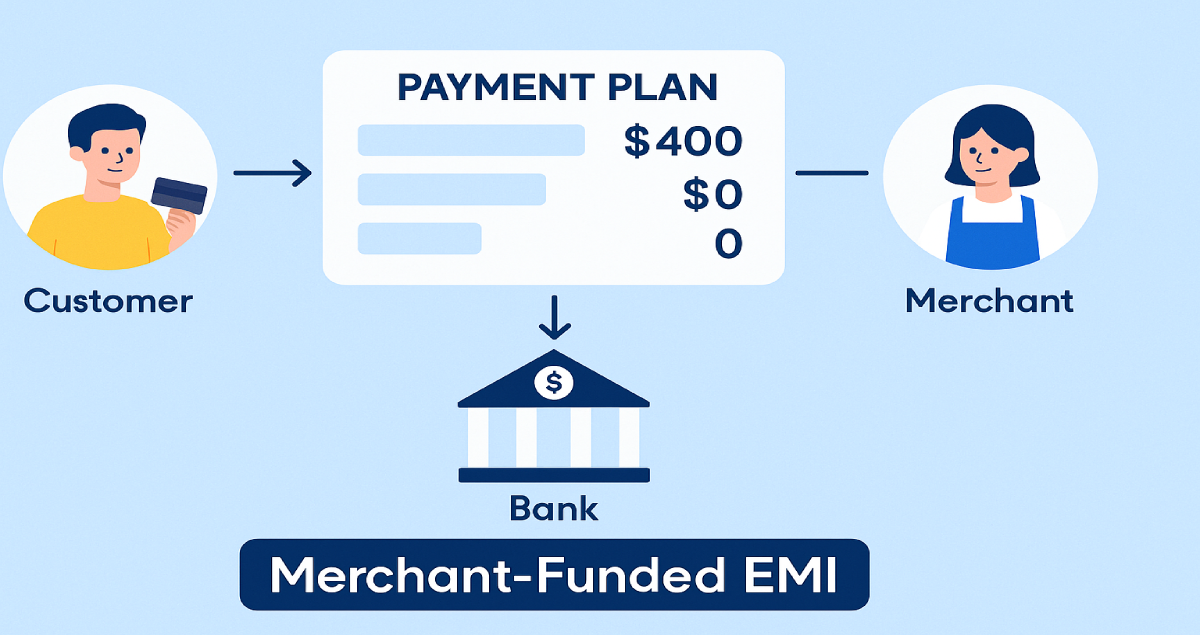

AMerchant-Funded EMI is a payment model in which the merchant itself bears the cost or provides the credit facility for converting a customer’s purchase into installments. Unlike bank-financed EMIs, where the financial institution lends the customer the purchase amount, merchant-funded EMIs work directly between the seller and the buyer.

In this arrangement, the customer pays the total amount in smaller monthly installments over a fixed tenure, while the merchant either:

- Foregoes a small part of the margin,

- Charges a nominal fee,

- Or absorbs the interest cost to make the offer more attractive.

This strategy enables customers to make large purchases more comfortably and helps merchants increase their conversion rates and average order values.

How Does It Work?

Here’s a step-by-step breakdown of how merchant-funded EMI typically works:

1. EMI Plan Creation

The merchant, using a platform like Secure EMI, creates an EMI plan at the time of billing. The merchant chooses the number of installments (e.g., 3, 6, 9, 12 months) and defines the terms, such as any processing fees or down payment required.

2. Mandate Setup via UPI Autopay or eNACH

The customer provides consent for automated debit by setting up a UPI Autopay or eNACH (Electronic National Automated Clearing House) mandate. This enables automatic deduction of the agreed EMI amount from the customer's bank account every month.

3. Real-Time KYC and Verification

Most EMI platforms perform merchant KYC (Know Your Customer) checks to ensure compliance. However, in a merchant-funded EMI model, customer KYC is minimal or optional depending on the merchant's risk preference.

4. Payment Collection

Each month, the EMI amount is auto-debited from the customer’s account and transferred directly into the merchant's account, after deducting a transaction fee if applicable. Platforms like Secure EMI automate this process end-to-end.

5. Dashboard Tracking and Reporting

The merchant can track upcoming, pending, or completed EMIs through a real-time dashboard. Reports can be downloaded for reconciliation, accounting, and customer service.

Merchant-Funded EMI empowers businesses to drive more conversions by absorbing interest costs and offering instant credit with minimal friction — making purchases easier for customers without traditional bank involvement.

Benefits of Merchant-Funded EMI

1. Boost in Sales

Offering EMIs increases the affordability of products, leading to higher sales conversions, especially for high-ticket items like electronics, appliances, and furniture.

2. Improved Customer Loyalty

Customers appreciate flexible payment terms and are more likely to return to a merchant that helps them manage cash flow without resorting to credit cards or personal loans.

3. Immediate Fund Transfer

Unlike loan-financed EMI, there is no delay in settlement. Merchants receive payments installment-wise in a timely, automated fashion.

4. Better Margins and Customization

Merchant-Funded EMI schemes enable consumers to buy premium products that might otherwise have been beyond their reach. Whether it’s the latest smartphone, an advanced television set, or even a high-end kitchen appliance, consumers can access these products without being financially constrained.

5. Easy Integration

With platforms like Secure EMI, merchants can integrate EMI options with their existing POS systems, websites, or billing software without overhauling their infrastructure.

Merchant-Funded vs Bank-Funded EMI

| Feature | Merchant-Funded EMI | Bank-Funded EMI |

|---|---|---|

| Credit Provider | Merchant | Bank or NBFC |

| Customer Approval | Instant, minimal checks | Requires credit assessment |

| Interest Cost | Borne by merchant or passed on | Charged by bank |

| Speed of Activation | Same-day | Several days |

| KYC Requirement | Merchant-side | Customer-side (mandatory) |

Credit Provider

Merchant-Funded EMI: Merchant

Bank-Funded EMI: Bank or NBFC

Customer Approval

Merchant-Funded EMI: Instant, minimal checks

Bank-Funded EMI: Requires credit assessment

Interest Cost

Merchant-Funded EMI: Borne by merchant or passed on

Bank-Funded EMI: Charged by bank

Speed of Activation

Merchant-Funded EMI: Same-day

Bank-Funded EMI: Several days

KYC Requirement

Merchant-Funded EMI: Merchant-side

Bank-Funded EMI: Customer-side (mandatory)

Use Cases Where Merchant-Funded EMI Shines

- Electronics Stores: High-ticket gadgets like smartphones, laptops, and TVs.

- Appliance & Furniture Retailers: Refrigerators, washing machines, sofas.

- Local Retail Shops: Small merchants who want to offer EMI without working with banks.

- Online D2C Brands: E-commerce platforms selling directly to customers.

- Medical Services: Clinics and labs offering diagnostic or elective treatments.

Risks and Considerations

- Customer Defaults: Merchants bear the risk if a customer fails to pay installments.

- Cash Flow Management: Revenue is spread over months; this requires strong cash flow planning.

- Technical Integration: EMI platforms must be secure and scalable.

- Compliance: Ensure mandates and KYC align with regulations (RBI, NPCI).

Platforms like Secure EMI help mitigate these risks by providing automated mandate management, retry logic, and real-time status alerts.

Conclusion

Merchant-funded EMI is a powerful sales enabler for modern retailers looking to offer affordability without relying on banks or lending partners. It gives merchants full control over their payment terms and allows customers to make big-ticket purchases without financial strain.

With tools like Secure EMI, the entire EMI lifecycle—from creation to collection—is automated and compliant. If you’re a merchant looking to boost conversions and customer satisfaction, offering merchant-funded EMI might just be your smartest move yet.

Leave a Comment